On August 16, 2022, one of the world’s most ambitious climate laws, the Inflation Reduction Act of 2022, was signed by the President of the United States, Joe Biden.

This piece of legislation represents one of the most ambitious initiatives globally for advancing clean energy and addressing climate change, and all in all, it is a significant piece of industrial policy. Yet, it has surprisingly failed to capture significant attention from the American public. While its aims are lofty, the contents of the bill haven’t fostered interest from the media or the public, given its very specific scale and scope.

While the bill’s title implies that it is mainly aimed at addressing inflation, the bill is mainly about industrial policy and American manufacturing, as shown in the contents of the bill.

In short, this act provides for record investments in domestic clean energy, allocates funding for research and development (R&D) for leading clean energy sources, and increases negotiating power granted to Medicare, allowing for lower drug costs.

The Breakdown

As one of the Biden Administration’s most fought-for pieces of legislation, the bill stems from the originally proposed American Families Plan as part of the wider Build Back Better plan, which died in Congress due to partisan bickering, especially from disagreements from Senator Joe Manchin (WV-Democratic) over key provisions of the American Families Plan, such as universal prekindergarten and the Child Tax Credit. Manchin, a bastion of the centrist Democrats movement and a longtime advocate for fiscal responsibility, killed the American Families Plan in late 2021 over disagreements on total spending and scope. of the bill.

But by July 2022, Manchin and Senate Majority Leader Chuck Schumer had agreed to a deal on a less ambitious version of the original bill, called the Inflation Reduction Act of 2022. This law will authorize $891 billion in total spending, including $783 billion for energy and climate change and three years of Affordable Care Act subsidies.

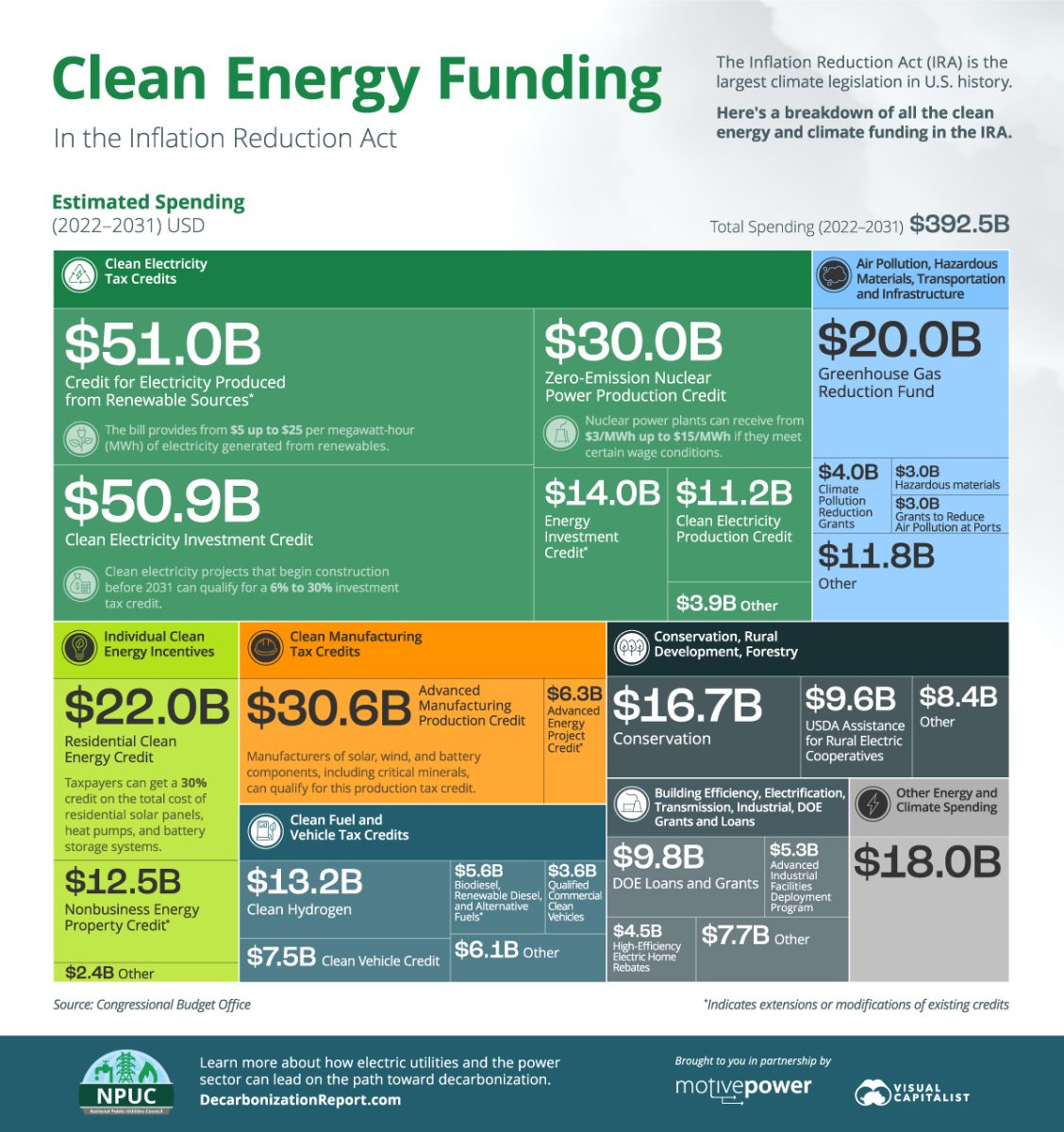

If we break down these investments, $157 billion in tax credits will be allocated for clean electricity, $45 billion will be given to mitigate air pollution, hazardous materials, and to invest in green transportation and infrastructure, $36 billion each in Individual Clean Energy Incentives and Clean Manufacturing Tax Credits, $35 billion on Clean Fuel and Vehicle Tax Credits, $34 billion on Conservation, Rural Development, and Forestry, $27 billion on grants and loans for building efficiency, electrification, transmission, industrial, and DOE spending, and $18 billion for miscellaneous climate spending.

This bill lowers prestation costs by allowing Medicare to negotiate prescription drug prices, capping insulin prices to $35 dollars and prescription drug costs for Medicare recipients to $2,000 per year, increasing corporate rebates to Medicare, and extending Affordable Care Act (ACA) Subsidies for three years.

Investments in STEM

As a way to strengthen science, technology, engineering, and math (STEM) fields, factories and other industries must meet STEM apprenticeship requirements. These fields will also be reinforced by the fact that the IRA has “Buy American” requirements, meaning that jobs will flow into the STEM sector and not be outsourced to outside players.

Source: McKinsey

Total Long-Term Impacts

The Congressional Budget Office, or CBO for should, estimated that the Inflation Reduction would result in a net decrease in the deficit totaling $90 billion over the course of the 2022-2031 fiscal period. This is due to part due to increasing corporate taxes, forcing large firms to pay a 15% minimum tax on their profits and establishing a 1% excise tax on stock buybacks and redemptions.

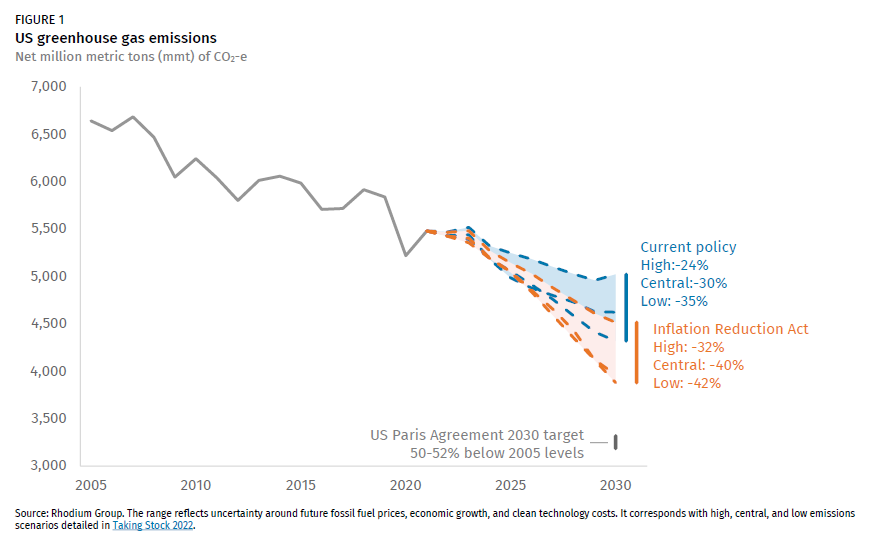

The bill will also reduce carbon emissions by 40%, versus the previous policy’s projection of 20%.

What does this mean for America — and the world?

The Inflation Reduction Act represents a fundamental shift in government policy away from the free trade and globalist rhetoric of previous administrations to more protectionist policies, and it reorients industries that America relies on from other countries back to the United States. These changes can be interpreted as a rebuke to the Bush and Clinton administrations’ practice of outsourcing jobs and favoring American industry, which has sparked concern in other markets, including the EU. But for whatever concerns that this bill may rise, it will be cemented in history as a fundamental shift in U.S. economic policy that will be reviewed for decades to come.

Related Stories:

- https://www.whitehouse.gov/cleanenergy/inflation-reduction-act-guidebook/

- https://www.epi.org/blog/the-inflation-reduction-act-finally-gave-the-u-s-a-real-climate-change-policy/

- https://decarbonization.visualcapitalist.com/breaking-down-clean-energy-funding-in-the-inflation-reduction-act/

- https://www.crfb.org/blogs/whats-inflation-reduction-act

- https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/15/by-the-numbers-the-inflation-reduction-act/

Take Action: